01

Case Study

| Project Overview | |||||

|---|---|---|---|---|---|

| Project | Document Upload Experience | Timeframe | 3 months | ||

| Role | Lead designer and researcher | KPI | User engagement and task completion | ||

Context

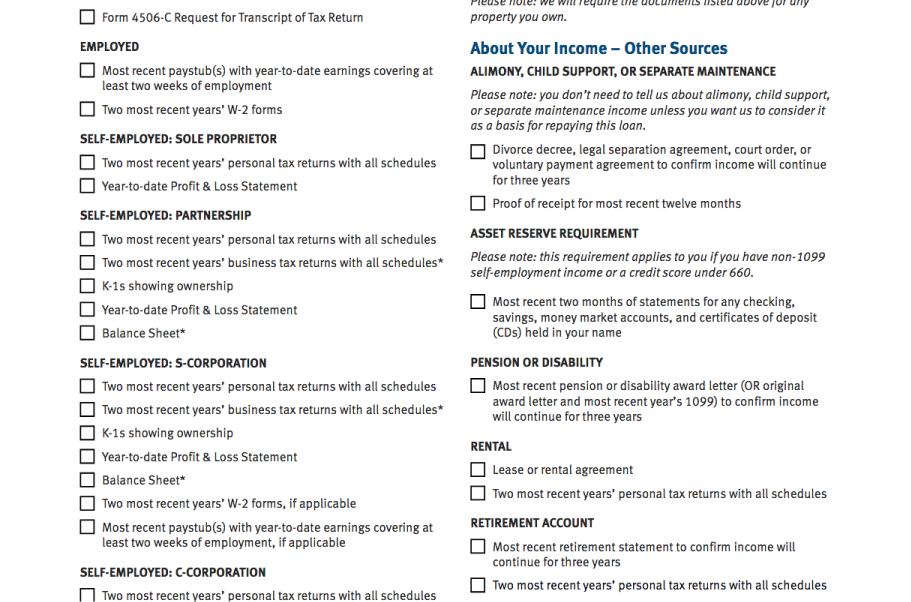

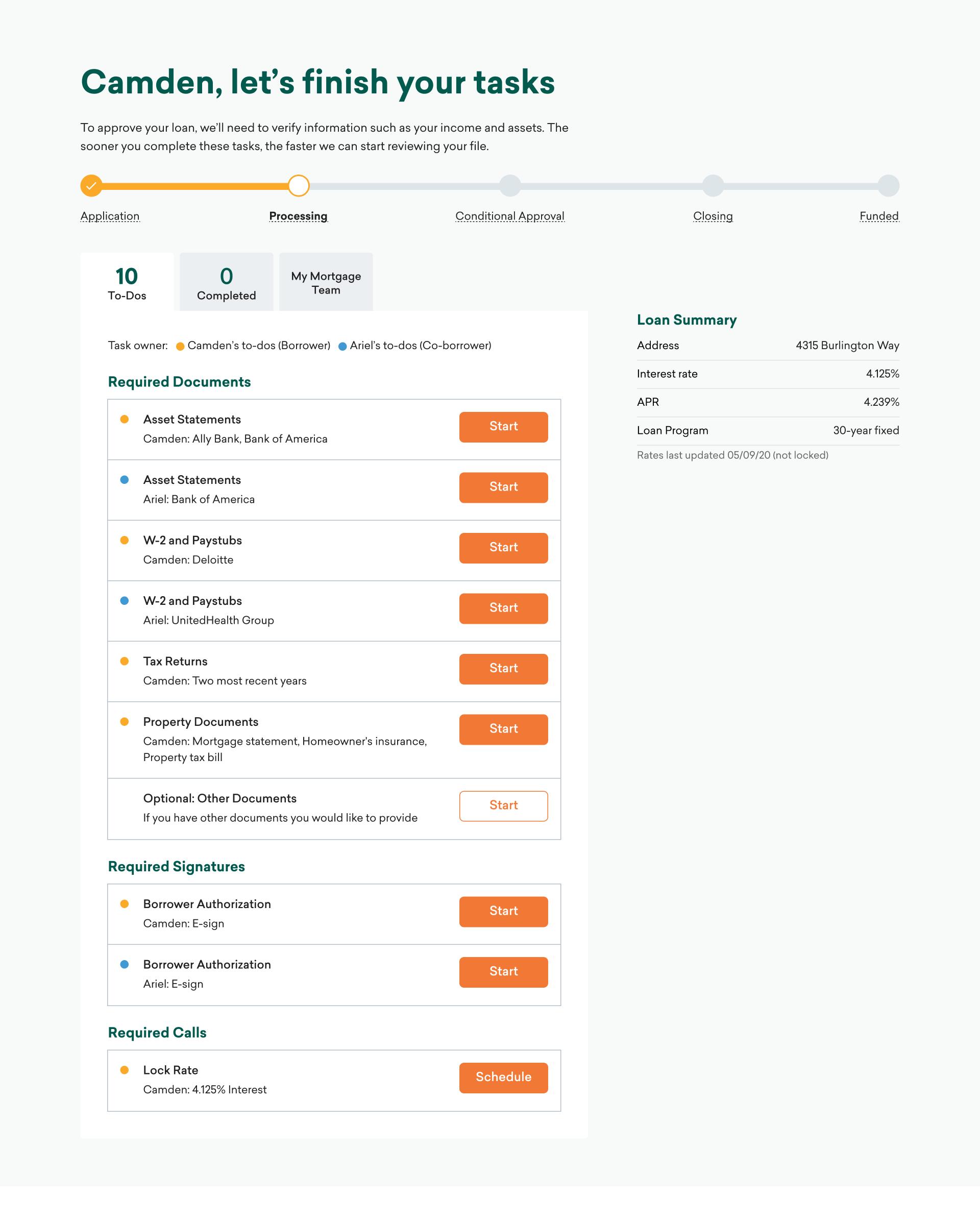

When users apply for a mortgage refinance, one of the last steps is to upload documents to verify their assets and home ownership.

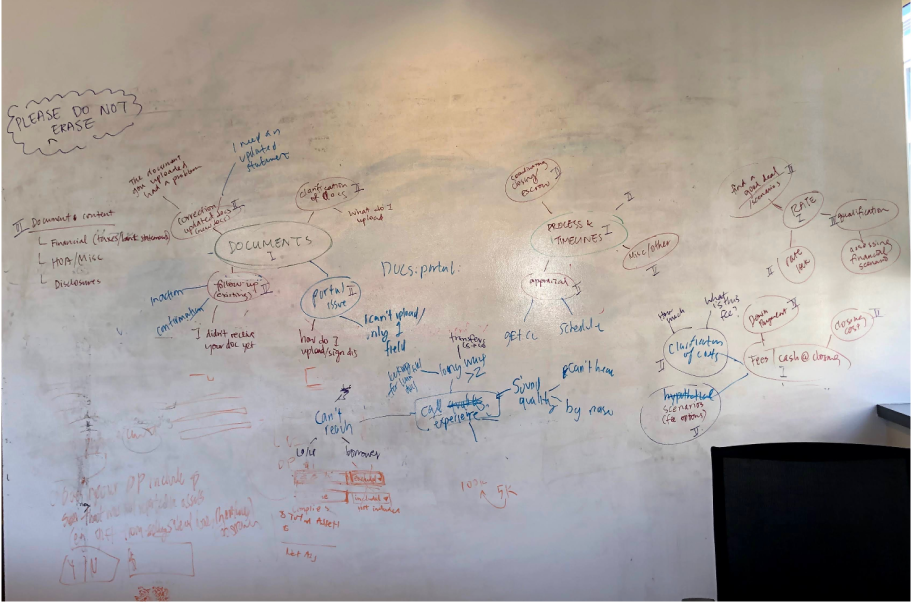

I interviewed homeowners who recently refinanced their home and mortgage loan officers to better understand the document verification process.

Key research takeaways:

- Users tend to feel overwhelmed at the amount of tasks and documents they need to complete

- Users sometimes struggle to find documents

- Loan officers reported high abandonment rates at doc upload stage

Some of the documents users have to upload

Affinity mapping of pain points from user interviews

Solution

Due to mortgage regulations, we are required to request these documents from users. So, how might we balance these document requirements without overwhelming users?

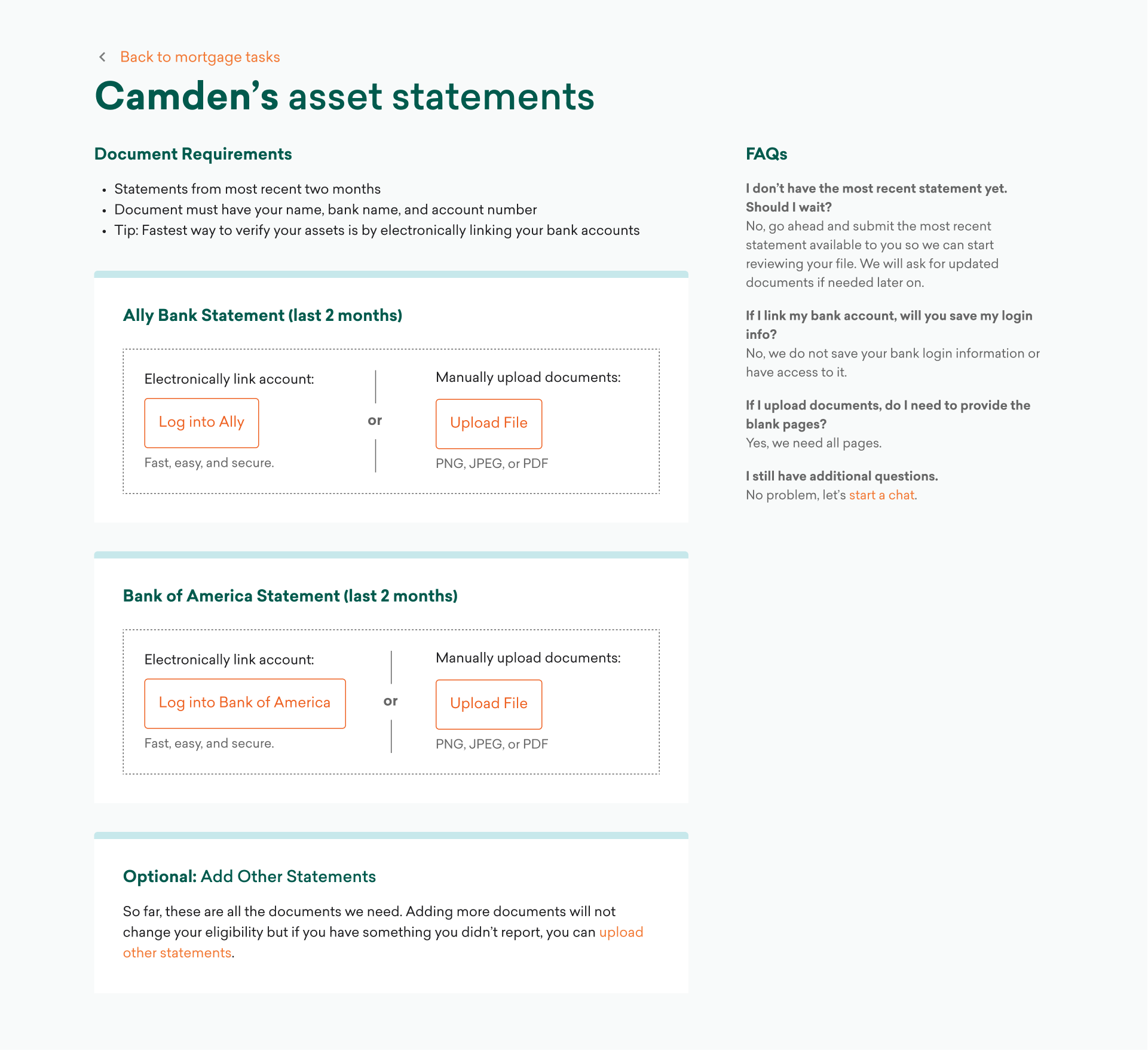

- Simplify - Can’t reduce number of docs, but we break it up into smaller steps

- Automate - Use 3rd party integrations to verify documents

- Take action - Help users get started quickly with an approachable UI that makes it easy to complete tasks

Process

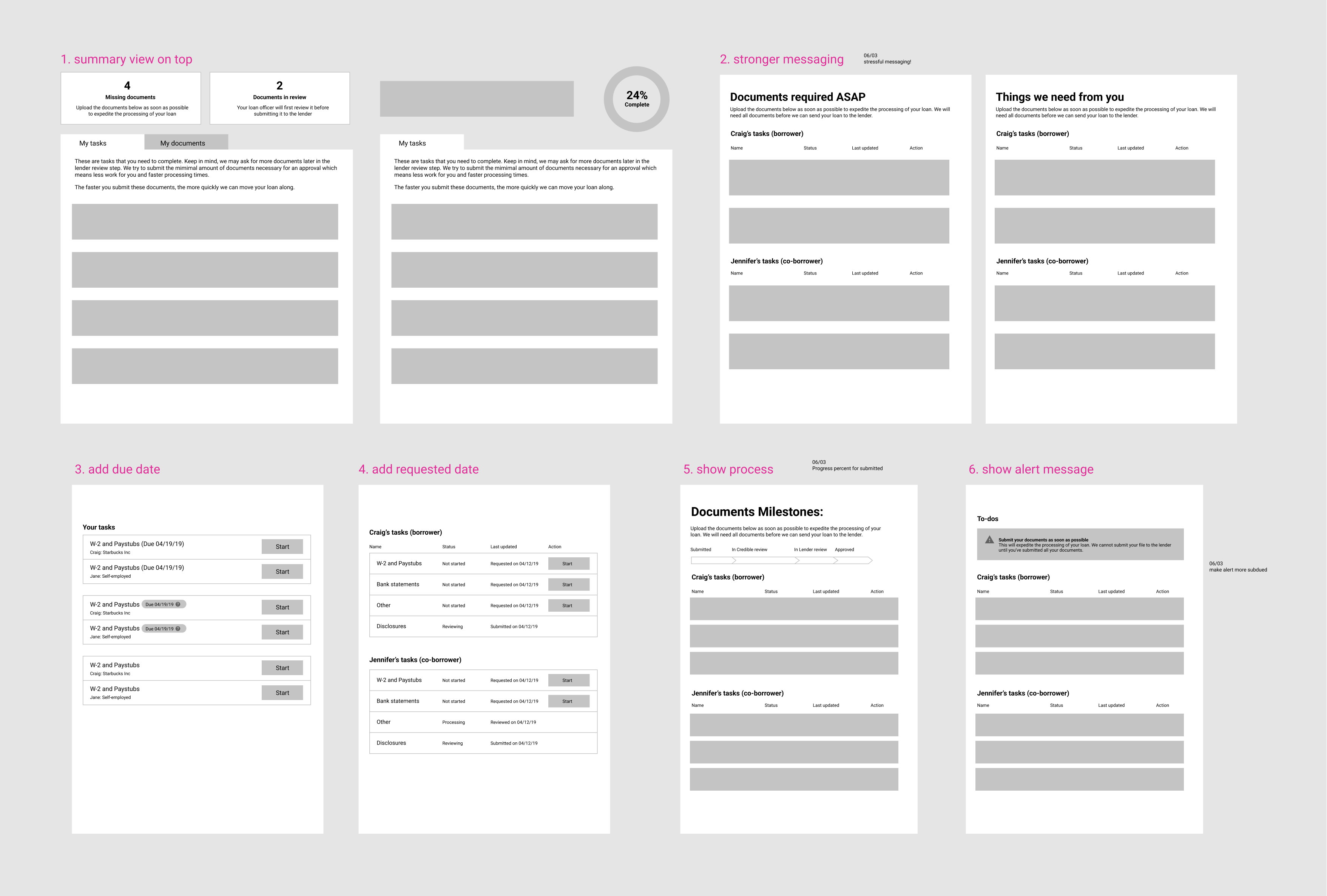

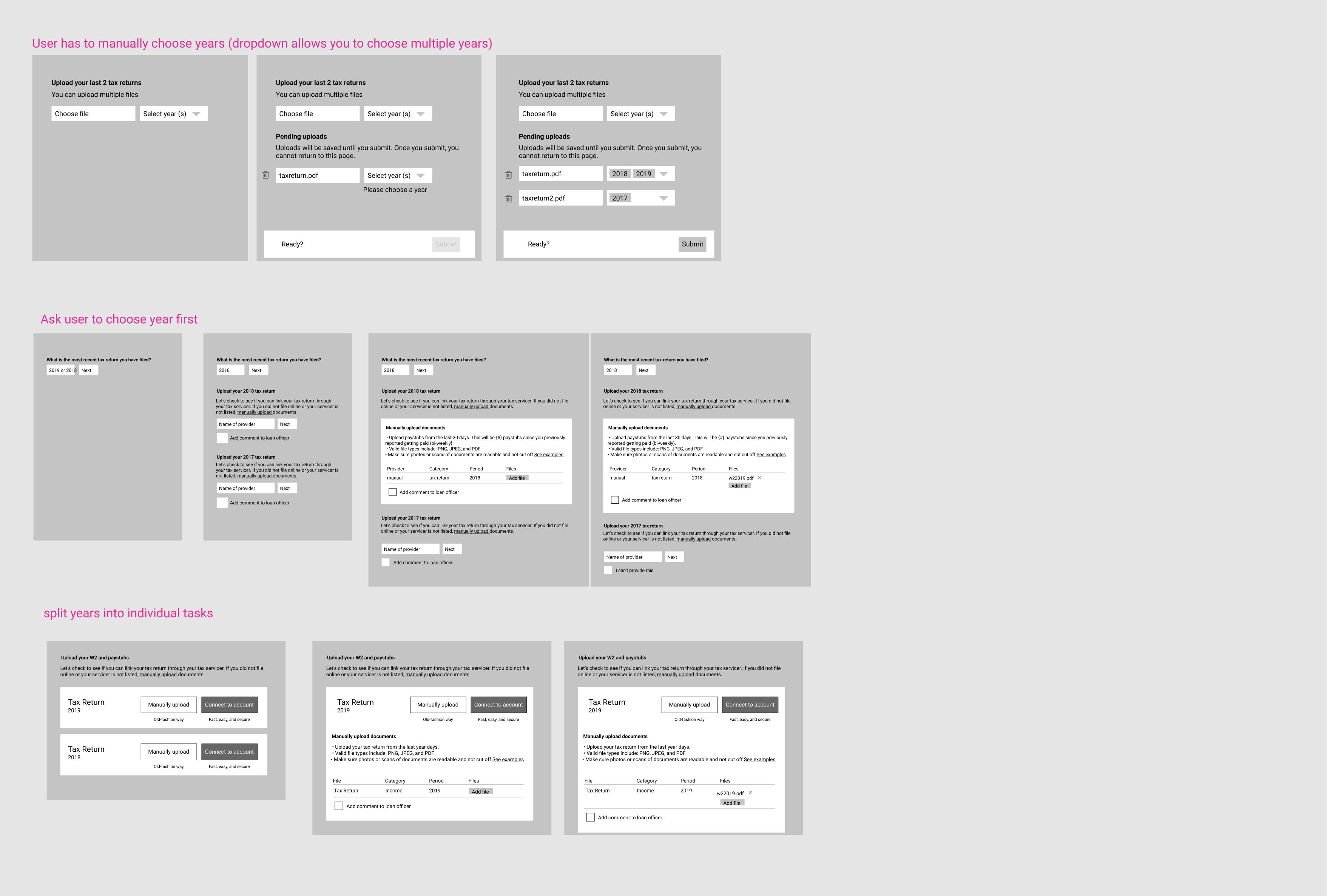

I started off with quick mockups in low fidelity with the goal of creating as many directions as possible. We then decided on a few directions and plugged in real content so we could validate the designs through user testing. Once we finalized on a direction, we went back to do visual UI explorations.

Document portal explorations

Document upload flow explorations

Outcome

By tracking data and interviewing users after they completed the process, here's what we learned and what changes we made.

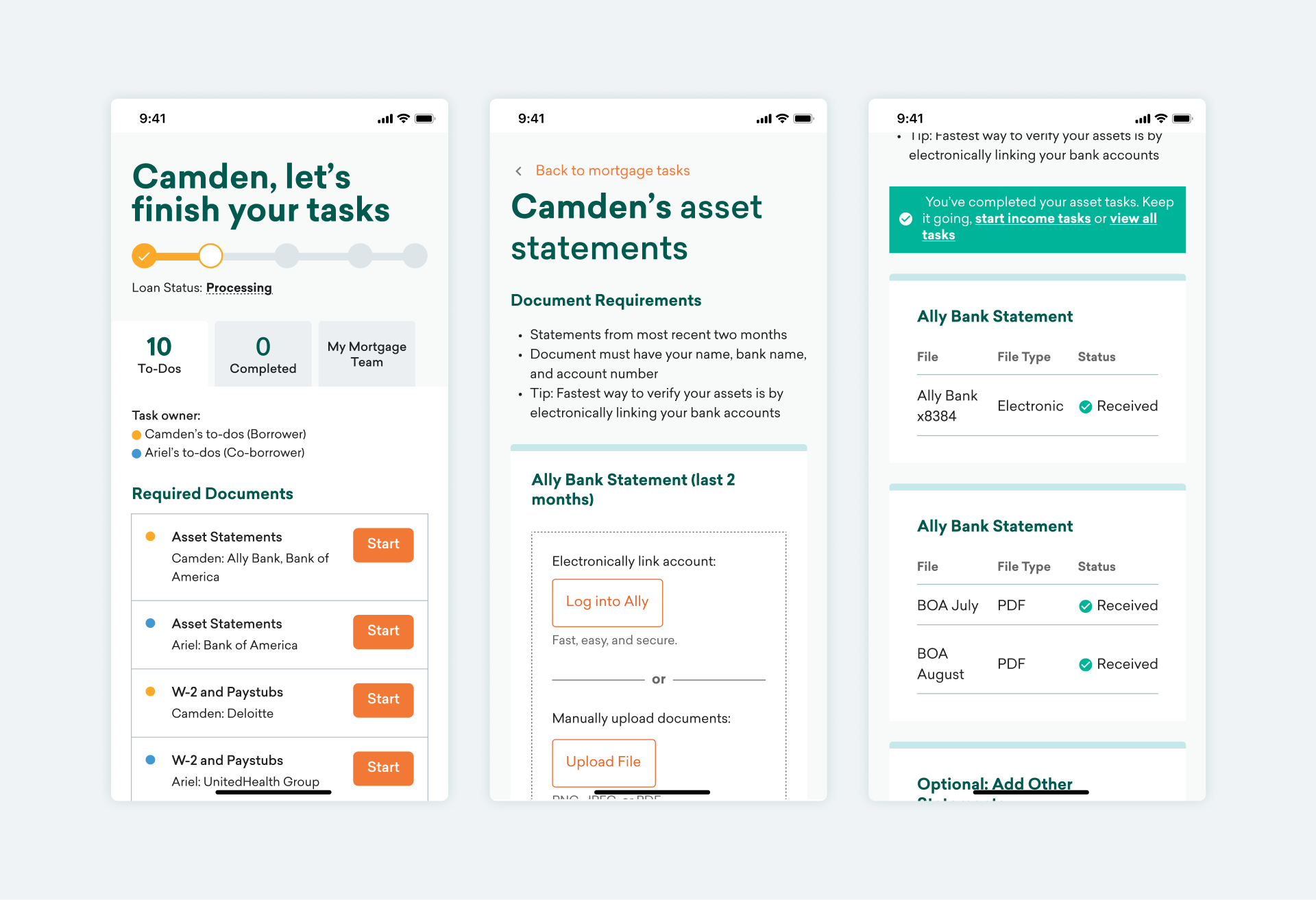

- Users who upload at least one document were more likely to complete the process. To encourage users to start at least one task, we ordered tasks by ease of completion. Bank assets were the easist for users to provide most likely because they logged into these sites more frequently so we listed asset tasks first.

- What people say and do are two different things. Although users reported they liked separating different tasks for borrowers and co-borrowers, we found that in reality one person is usually the lead and checks up on any outstanding tasks. To maintain efficiency, we did not separate out borrower and co-borrower tasks.

- Trust sometimes outweighs speed. We initially defaulted users to electronically verify their documents since it was the fastest and most accurate method. But some users didn't feel comfortable with it and preferred to manually upload documents even if it was more time consuming.

To address the drop off on this page, we A/B tested two designs. For one test, we added more trust value props to encourage electronically linking your account and in another test, we gave automatic and manual paths equal weight. The latter won out and increased completion rates.

Borrower and co-borrower tasks in one view. We also used card sort exercises with home owners and loan officers to organize categories and label tasks.

Users were give the path to electronically verify or manually upload their documents.

For mobile designs, we wanted to ensure that a CTA was in the viewport so users knew it was an actionable page.

Copyright 2022

Designed + coded by Bena Li